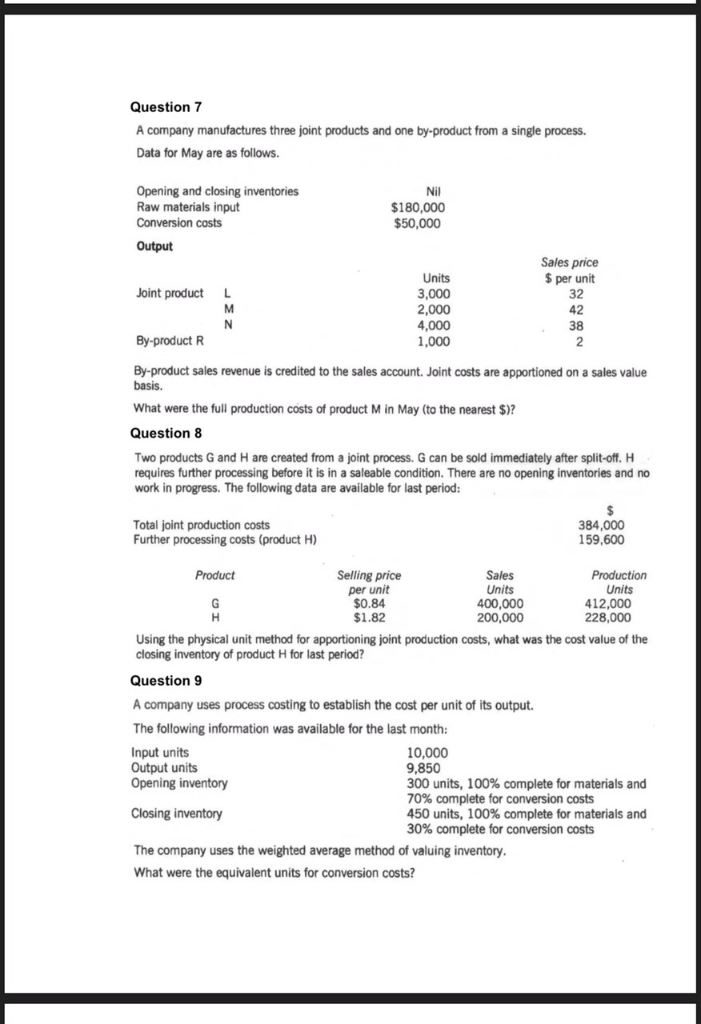

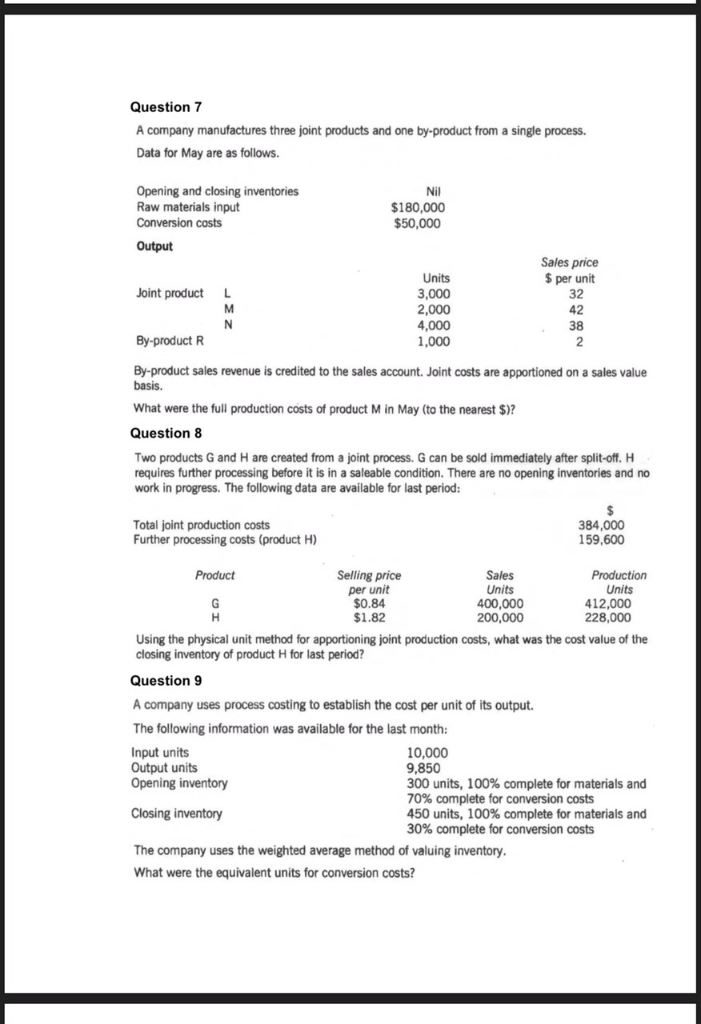

By-product costing and joint product costing

The company sells each floor mat for $$\$ 12$$ and each car mat for $$\$ 6$$. The company treats the rubber shreds as a byproduct that can be sold for $$\$ 0.70$$ per pound.1. What is the ending inventory cost for each product and gross margin for Cloths of Heaven?

Processing Costs

Each batch totals 4,000 pounds of coconut and 6,000 pounds of coconut water. Both products are processed further without a gain or loss in volume. Separable processing costs for the coconut are $$\$ 1.47$$ per pound and for the coconut water are $$\$ 2.02$$ per pound. Coconut sells for $$\$ 6.30$$ per pound and the coconut water sells for $$\$ 5.80$$ per pound.1. How much of the joint costs per batch will be allocated to coconut and to coconut water, assuming that joint costs are allocated based on the number of pounds at the splitoff point?

Additionally, fixed overhead of $6,000 would be allocated to the

The costs allocated to joint products and by-products should have no bearing on the pricing of these products, since the costs have no relationship to the value of the items sold. Prior to the split-off point, all costs incurred are sunk costs, and as such have no bearing on any future decisions – such as the price of a product. Byproduct-costing journal entries (continuation of 17-38).

Sales value after further processing $615 $445 $975

Besides the split-off point, there may also be one or more by-products. Given the immateriality of by-product revenues and costs, byproduct accounting tends to be a minor issue. Methods of joint-cost allocation, comprehensive. Kardash Cosmetics purchases flowers in bulk and processes them into perfume. From a certain mix of petals, the firm uses Process A to generate Seduction, its high-grade perfume, as well as a certain residue. The residue is then further treated, using Process B, to yield Romance, a medium-grade perfume.

a-1. Should Product A be sold immediately or sold after processing further? Sell Now Sell Later

Show journal entries at the time of production and at the time of sale assuming Cloths of Heaven’s accounts for the byproduct using the sales method. The situation is quite different for any costs incurred from the split-off point onward. Since these costs can be attributed to specific products, you should never set a product price to be at or below the total costs incurred after the split-off point. Otherwise, the company will lose money on every product sold. “Managers should consider only additional revenues and separable costs when making decisions about selling at splitoff or processing further.” Do you agree? Cloths of Heaven purchases old tires and recycles them to produce rubber floor mats and car mats.

An ounce of residue typically yields an ounce of Romance. Describe two major methods to account for byproducts. Give two limitations of the physical-measure method of joint-cost allocation. instructions for form 5695 (CMA, adapted) Newcastle Mining Company (NMC) mines coal, puts it through a one-step crushing process, and loads the bulk raw coal onto river barges for shipment to customers.

The total joint manufacturing costs for the year were $f 580,000$. KZee spent an additional $f 200,000$ to finish product C. Under this method, Hassle Corporation designates Product Charlie as a by-product, so it does not share in the allocation of costs. If the company eventually sells any of Product Charlie, it will net the resulting revenues against the costs assigned to Products Alpha and Beta. Describe a situation in which the sales value at splitoff method cannot be used but the NRV method can be used for joint-cost allocation.

- From a certain mix of petals, the firm uses Process A to generate Seduction, its high-grade perfume, as well as a certain residue.

- Use the sale proceeds to reduce the common costs in the joint production process.c.

- The floor and car mats are cut from these sheets.

- The company has hired you as a consultant to help its accountant.1.

- The company washes, shreds, and molds the recycled tires into sheets.

If joint costs are allocated on an NRV basis, how much of the joint costs will be allocated to the coconut and to the coconut water? Prepare product-line income statements per batch for requirements 1 and 2. Assume no beginning or ending inventories of either product.4. The company has the option of processing the coconut further and producing coconut slices. The selling price of the coconut slices would be $$\$ 8$$ per pound after incurring additional processing costs of $$\$ 0.3875$$ per pound.

He has also been running a side business for the past couple of years. Carl has set himself up as a purchaser of these captured snakes.

Alternative joint-cost-allocation methods, further-process decision. The Palm Company produces two products – coconut and coconut water-by a joint process. Joint costs amount to $$\$ 14,000$$ per batch of output.